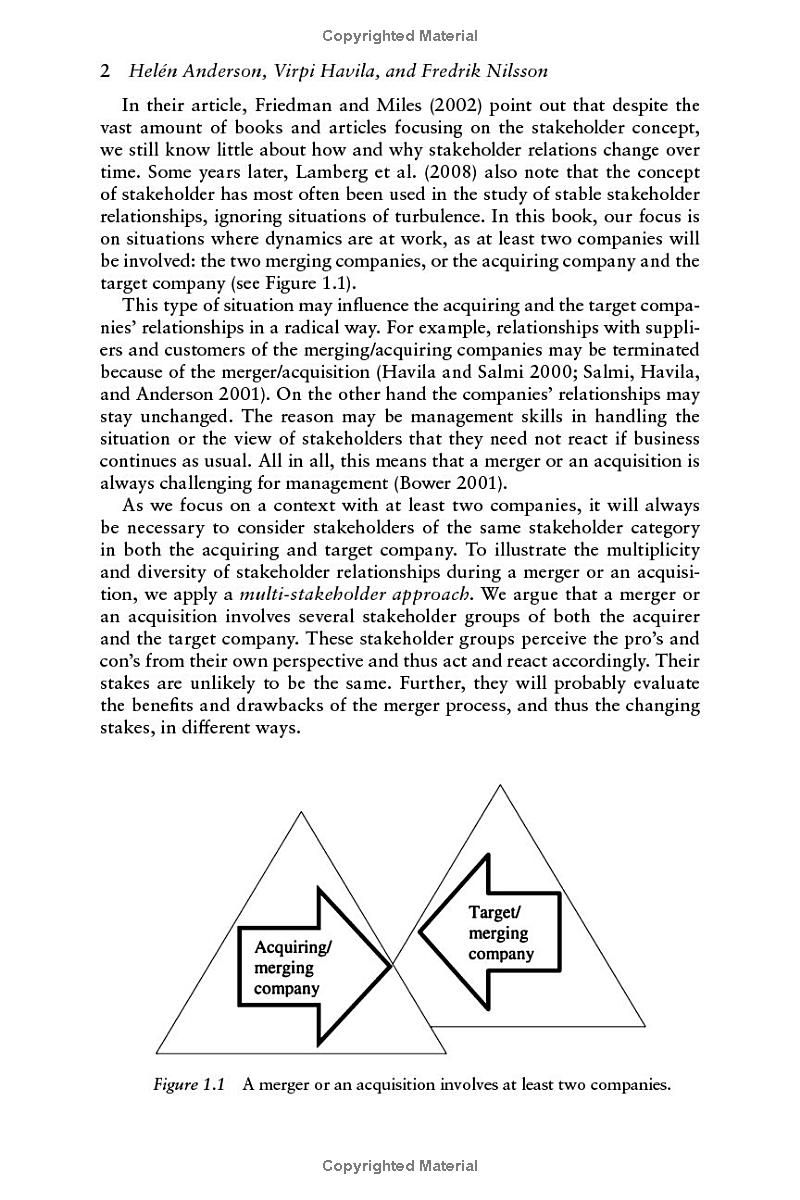

Fredrik Nilsson and Helén Anderson's "Mergers and Acquisitions" offers a crucial re-evaluation of this complex business process. While traditional approaches prioritize owner value, this book argues that a broader stakeholder perspective is essential for successful mergers and acquisitions (M&A). Drawing on empirical evidence, it demonstrates the significant impact of internal and external stakeholders – employees, managers, customers, communities – throughout the M&A lifecycle. By examining the active roles these stakeholders play, the authors shed light on why some M&A endeavors thrive while others fail. This insightful volume moves beyond a narrow focus on merging organizations, providing a comprehensive framework for understanding and improving M&A outcomes.

Review Mergers and Acquisitions

Let me tell you, "Mergers and Acquisitions" by Nilsson and Anderson isn't your typical dry academic text. While it certainly dives deep into the complexities of mergers and acquisitions (M&A), it does so in a way that feels surprisingly engaging. I wouldn't say it's a breezy beach read, but the subject matter, while dense, is handled with a clarity and structure that makes it remarkably accessible. The authors clearly understand the importance of making this complex topic understandable, and they succeed admirably.

What really sets this book apart is its focus on stakeholders. So often, discussions around M&A center solely on the financial bottom line, on shareholder value. This book flips that script, highlighting the crucial – and often overlooked – role that all stakeholders play in the success or failure of these massive undertakings. From employees and managers within the merging companies to external stakeholders like customers, suppliers, and even the wider community, the book meticulously explores how each group's interests and concerns directly impact the outcome.

This isn't just theoretical postulating either. The strength of "Mergers and Acquisitions" lies in its robust empirical basis. The authors skillfully weave together a number of serious studies and real-world examples to illustrate their points. Instead of simply stating that stakeholder engagement is important, they demonstrate it through compelling case studies, showcasing both the positive impact of thoughtful stakeholder management and the devastating consequences of neglecting their concerns. This practical approach makes the information immediately relevant and applicable, even for those without a background in business or finance.

While the book doesn't shy away from the intricacies of M&A processes – and indeed, delves into them with commendable detail – it avoids becoming overly technical or jargon-heavy. The writing is clear, concise, and well-organized. It's the kind of book where you can readily jump into a specific chapter, focusing on a particular aspect that interests you, without feeling lost or overwhelmed. The structure allows for flexible reading, making it useful as a reference tool as well as a comprehensive study.

I found the book’s exploration of the challenges in measuring the success of M&A particularly insightful. The authors don’t offer easy answers, but they do offer a more nuanced and holistic perspective on how success should be defined, going beyond simply looking at financial metrics. This thoughtful approach underscores the value of a stakeholder-centric viewpoint.

Ultimately, while I might hesitate to give it a perfect score simply because of the inherently complex nature of the subject matter, "Mergers and Acquisitions" is a valuable and significant contribution to the field. It's a must-read for anyone seriously involved in or studying M&A, and a highly recommended resource for anyone interested in gaining a more complete and insightful understanding of these powerful, transformative business events. The authors have undeniably filled a gap in the literature, providing a much-needed comprehensive and accessible overview of the critical role stakeholders play in shaping the ultimate success or failure of mergers and acquisitions. It’s a book worth checking out, indeed, and one that will likely stay on my bookshelf for future reference.

Information

- Dimensions: 5.98 x 0.69 x 9.02 inches

- Language: English

- Print length: 304

- Part of series: Routledge Advances in Management and Business Studies

- Publication date: 2024

Preview Book